Managing personal finances can feel overwhelming. Organizing expenses, tracking investments, and budgeting effectively requires dedication and tools.

Personal finance management is essential for achieving financial stability. With the right approach, you can gain control over your money, reduce stress, and work towards financial goals. This blog post introduces Monarch Money, a powerful tool designed to simplify and enhance your financial life.

Monarch Money combines all your accounts into one intuitive interface, making it easier to track, budget, and plan. Whether you’re aiming to save for a vacation, manage your investments, or simply keep an eye on your spending, Monarch Money offers features tailored to your needs. Discover how this app can transform your approach to personal finance management and help you reach your financial goals.

Introduction To Personal Finance Management

Managing your personal finances is crucial for achieving financial stability and success. It involves tracking your income, expenses, savings, and investments to ensure you meet your financial goals. In this guide, we will explore the essentials of personal finance management and how tools like Monarch Money can help simplify this process.

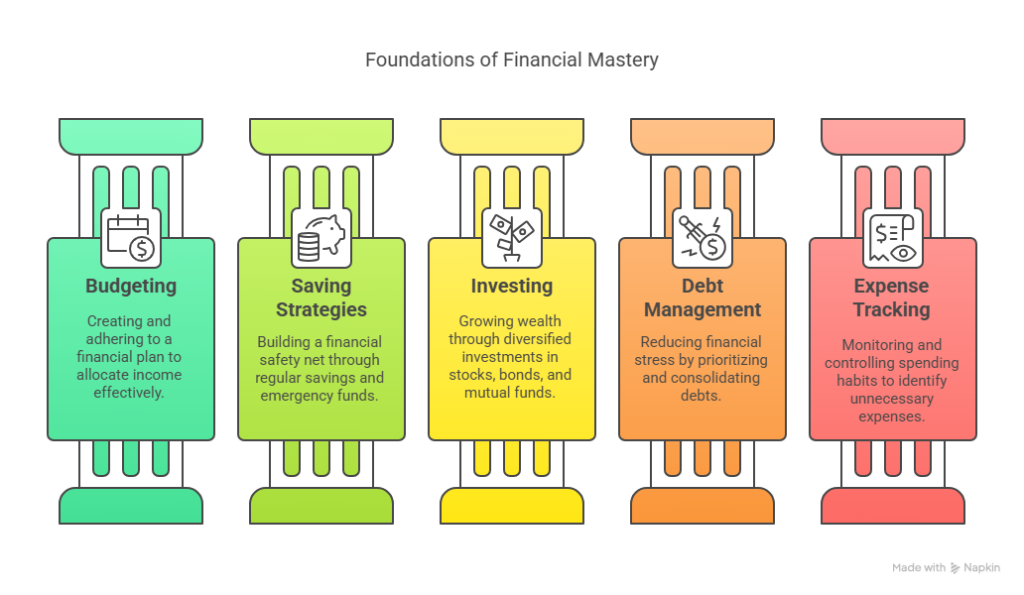

Understanding The Importance Of Financial Literacy

Financial literacy is the knowledge and skills needed to manage your money effectively. It includes understanding budgeting, saving, investing, and debt management. Without proper financial literacy, individuals may struggle to make informed decisions about their finances.

- Helps avoid debt and financial pitfalls

- Enables informed financial decisions

- Promotes savings and investment for future goals

Being financially literate empowers you to create a budget, track your spending, and save for emergencies. It also helps you understand the impact of interest rates and the benefits of investing early. With these skills, you can build a solid financial foundation and work towards long-term prosperity.

The Purpose Of Managing Personal Finances

Personal finance management is essential for maintaining financial health. It involves creating a budget, tracking expenses, and setting financial goals. Effective management helps you live within your means and prepare for the future.

- Control over your financial life

- Reduction of financial stress

- Achievement of financial goals

Using a financial management app like Monarch Money can make this process easier. Monarch Money aggregates your bank accounts, credit cards, and investments into one intuitive interface. This provides a comprehensive view of your finances, making it easier to budget, track spending, and plan for future financial goals.

Key features of Monarch Money include:

| Feature | Description |

|---|---|

| Tracking | Monitor net worth, spending, and cash flow |

| Budgeting | Create flexible budgets that adapt to your lifestyle |

| Collaboration | Share financial information with your partner |

| Planning | Set and track goals for various financial objectives |

| Dashboard | Customize with widgets for essential insights |

By using these tools, you can simplify your financial management, stay on top of your finances, and work towards a secure financial future.

Credit: eddyandschein.com

Key Features Of Effective Personal Finance Management

Managing personal finances efficiently is crucial for financial stability and growth. Effective personal finance management involves various key features that help in organizing, planning, and controlling your financial activities. Here are some of the essential aspects to consider:

Budgeting is the cornerstone of personal finance management. It helps you allocate your income towards expenses, savings, and investments. A well-planned budget keeps your finances on track and prevents overspending.

Using tools like Monarch Money, you can create flexible budgets that adapt to your lifestyle. This app allows you to categorize expenses and set limits, ensuring you stay within your financial means.

Effective saving strategies are vital for building a financial safety net. Start by setting aside a portion of your income regularly. Emergency funds can protect you from unexpected expenses.

Monarch Money helps you plan and track your savings goals. Whether saving for a vacation or home remodel, the app’s planning feature ensures you stay focused and motivated.

Investing is essential for wealth growth. Diversifying your investments across stocks, bonds, and mutual funds can yield significant returns over time.

With Monarch Money, you can monitor your investments and get insights on their performance. The app aggregates all your financial accounts, providing a clear view of your net worth and investment portfolio.

Managing debt effectively reduces financial stress. Prioritize paying off high-interest debts first. Consider consolidation if you have multiple loans.

Monarch Money tracks your debts and helps you create a repayment plan. By setting reminders and monitoring your progress, you can gradually reduce your financial burden.

Tracking expenses is critical for understanding and controlling your spending habits. Regularly review your transactions to identify unnecessary expenses.

Monarch Money offers a comprehensive transaction management feature. Customize preferences, review expenses, and get monthly financial summaries to stay on top of your spending.

Budgeting: The Foundation Of Financial Stability

Budgeting is the cornerstone of financial stability. It helps you understand where your money goes, how you can save, and what you need to adjust to meet your financial goals. With a well-planned budget, you can avoid debt, save for the future, and enjoy peace of mind.

Creating A Realistic Budget

Creating a realistic budget involves analyzing your income, expenses, and financial goals. Start by listing all sources of income and fixed expenses, such as rent, utilities, and groceries. Identify variable expenses like entertainment and dining out, and allocate funds for savings and emergencies.

Here’s a simple table to help you get started:

| Category | Amount |

|---|---|

| Income | $3000 |

| Rent | $1000 |

| Utilities | $200 |

| Groceries | $400 |

| Entertainment | $150 |

| Savings | $500 |

| Emergency Fund | $200 |

Ensure you adjust these amounts based on your specific needs and priorities.

Tools And Apps For Budgeting

Utilizing tools and apps can simplify budgeting. Monarch Money is an excellent option. It brings all your accounts together into one clear view, helping you track, budget, plan, and collaborate on your finances.

- Tracking: Monitor your net worth, spending, and cash flow.

- Budgeting: Create flexible budgets that adapt to your lifestyle.

- Collaboration: Share financial information with your partner or financial professional.

- Planning: Set and track goals for vacations, home remodels, and other financial objectives.

Monarch Money provides a comprehensive view of all financial accounts in one place, enabling precise tracking and budgeting tailored to individual needs.

Sticking To Your Budget

Sticking to your budget requires discipline and regular review. Here are some tips:

- Track your spending: Regularly update your budget to reflect actual spending.

- Set realistic goals: Ensure your budget aligns with your financial goals and lifestyle.

- Adjust as needed: Life changes, and so should your budget. Adjust it to stay on track.

- Use reminders: Set reminders for bill payments and savings contributions.

- Review monthly: Analyze your budget monthly to identify areas for improvement.

Using a tool like Monarch Money can help you stay on track with its customizable dashboard, monthly reviews, and real-time updates from over 13,000 financial institutions.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Credit: www.investopedia.com

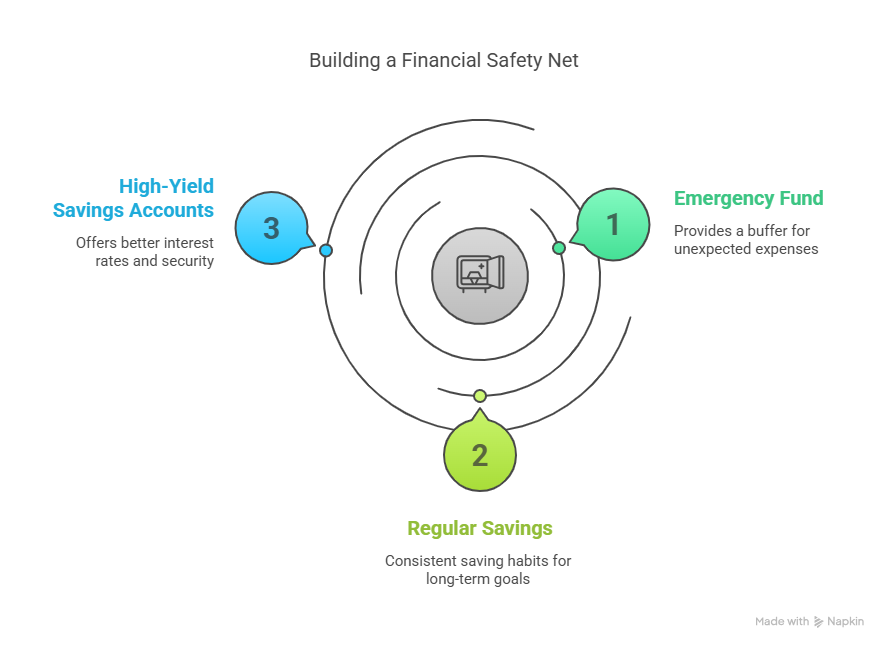

Saving Strategies: Building A Safety Net

Creating a financial safety net is essential for stability and peace of mind. Implementing effective saving strategies ensures you are prepared for unexpected expenses. Below, we explore key components of building a safety net, including the importance of an emergency fund, tips for regular savings, and the benefits of high-yield savings accounts.

Importance Of An Emergency Fund

An emergency fund acts as a financial buffer during unforeseen situations. This fund covers unexpected expenses like medical emergencies, car repairs, or job loss.

- Peace of Mind: Knowing you have a safety net reduces stress.

- Financial Stability: Avoids debt when unexpected costs arise.

Experts recommend saving three to six months’ worth of living expenses in your emergency fund.

Tips For Regular Savings

Consistently setting aside money can be challenging, but with the right tips, it becomes manageable.

- Set Clear Goals: Define what you are saving for.

- Automate Savings: Use automatic transfers to your savings account.

- Track Spending: Monitor expenses to identify saving opportunities.

- Adjust Budget: Regularly review and tweak your budget.

Using tools like Monarch Money can simplify tracking and budgeting.

High-yield Savings Accounts

A high-yield savings account offers better interest rates compared to regular savings accounts.

| Feature | Benefits |

|---|---|

| Higher Interest Rates | Earn more on your saved money. |

| FDIC Insured | Your money is safe up to $250,000. |

| Easy Access | Withdraw funds when needed without penalties. |

Selecting the right account ensures your savings grow efficiently. Monarch Money can help track and manage these accounts seamlessly.

Investing: Growing Your Wealth

Investing is a powerful tool to grow your wealth over time. It involves putting your money into various assets with the expectation of earning a return. With proper investment strategies, you can achieve financial security and meet your long-term goals. Monarch Money helps you track and manage your investments, ensuring you make informed decisions.

Understanding Different Types Of Investments

Investing offers a variety of options, each with its own risk and return characteristics. The main types include:

- Stocks: Shares of ownership in a company. They offer high returns but come with higher risk.

- Bonds: Loans to companies or governments. They provide regular interest payments and are considered safer than stocks.

- Mutual Funds: Pooled funds from many investors to buy a diversified portfolio of stocks and bonds. They reduce risk through diversification.

- Real Estate: Investing in property. It offers potential rental income and long-term appreciation.

- ETFs: Exchange-Traded Funds, similar to mutual funds but traded on stock exchanges. They offer flexibility and lower costs.

Risk Management In Investing

Risk management is essential to protect your investments. Here are some strategies:

- Diversification: Spread your investments across different asset classes to reduce risk.

- Asset Allocation: Adjust your portfolio based on your risk tolerance and investment goals.

- Regular Review: Monitor and rebalance your portfolio periodically with tools like Monarch Money.

- Emergency Fund: Maintain a cash reserve to cover unexpected expenses without touching your investments.

Long-term Vs Short-term Investment Strategies

Investment strategies can be categorized based on the time horizon:

| Long-term | Short-term |

|---|---|

| Focuses on growth over several years or decades. | Aims for quick gains within months or a few years. |

| Examples: Retirement accounts, real estate. | Examples: Day trading, speculative stocks. |

| Less affected by market volatility. | Highly sensitive to market movements. |

| Compound interest works in your favor. | Potential for high returns but also significant losses. |

Choosing the right investment strategy depends on your financial goals and risk tolerance. Monarch Money’s comprehensive tools can help you plan and track your investments effectively. With features like net worth tracking, budgeting, and expense categorization, you can stay on top of your financial health and make better investment decisions.

Credit: www.edynamiclearning.com

Debt Management: Reducing Financial Burden

Managing debt is crucial for financial health. Reducing debt can ease stress and improve your financial future. Monarch Money simplifies this process by providing a clear view of all your financial accounts in one place. Below, we’ll explore key strategies for paying off debt, options for consolidation and refinancing, and tips for avoiding future debt.

Strategies For Paying Off Debt

Effective debt management starts with a solid plan. Here are some strategies to consider:

- Debt Snowball Method: Pay off smaller debts first to gain momentum.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first.

- Balance Transfer: Move high-interest debt to a card with a lower rate.

- Extra Payments: Make extra payments whenever possible to reduce the principal.

Using Monarch Money’s budgeting feature, you can allocate extra funds towards debt repayment, track progress, and stay motivated.

Consolidation And Refinancing Options

Debt consolidation and refinancing can simplify debt management. Here’s how:

| Option | Benefits | Considerations |

|---|---|---|

| Debt Consolidation | Combines multiple debts into one payment. Often has lower interest rates. | May require good credit. Fees might apply. |

| Refinancing | Replaces current debt with new debt at a lower interest rate. | Potentially extends repayment period. May involve closing costs. |

Monarch Money’s transaction management feature helps you track payments and stay on top of your newly consolidated or refinanced debt.

Avoiding Future Debt

Preventing future debt is as important as paying off current debt. Here are some tips:

- Create a Budget: Use Monarch Money’s budgeting tools to plan your spending.

- Build an Emergency Fund: Set aside money for unexpected expenses.

- Live Within Your Means: Spend less than you earn.

- Monitor Your Financial Health: Regularly check your spending and savings goals using Monarch Money’s dashboard.

By following these tips and leveraging Monarch Money’s features, you can achieve greater financial stability and avoid falling into debt.

Expense Tracking: Monitoring Your Spending Habits

Expense tracking is vital for managing personal finances. Monitoring your spending habits can help you stay on budget, save more, and reach your financial goals faster. Understanding where your money goes can reveal opportunities to cut unnecessary expenses and improve your financial health.

Benefits Of Tracking Expenses

Tracking expenses offers several key benefits:

- Increased Awareness: Knowing where your money goes helps you make informed decisions.

- Budget Control: Stay within your budget by monitoring spending in real-time.

- Identify Wasteful Spending: Spot and reduce unnecessary expenses.

- Financial Goals: Allocate funds effectively to reach your goals faster.

Best Practices For Tracking Spending

Here are some best practices to track your spending efficiently:

- Record Every Expense: Track all expenses, no matter how small.

- Categorize Expenses: Group expenses into categories like groceries, utilities, and entertainment.

- Set a Budget: Create a budget and stick to it.

- Review Regularly: Review your spending weekly or monthly to stay on track.

- Use Tools: Utilize apps and tools for accurate tracking.

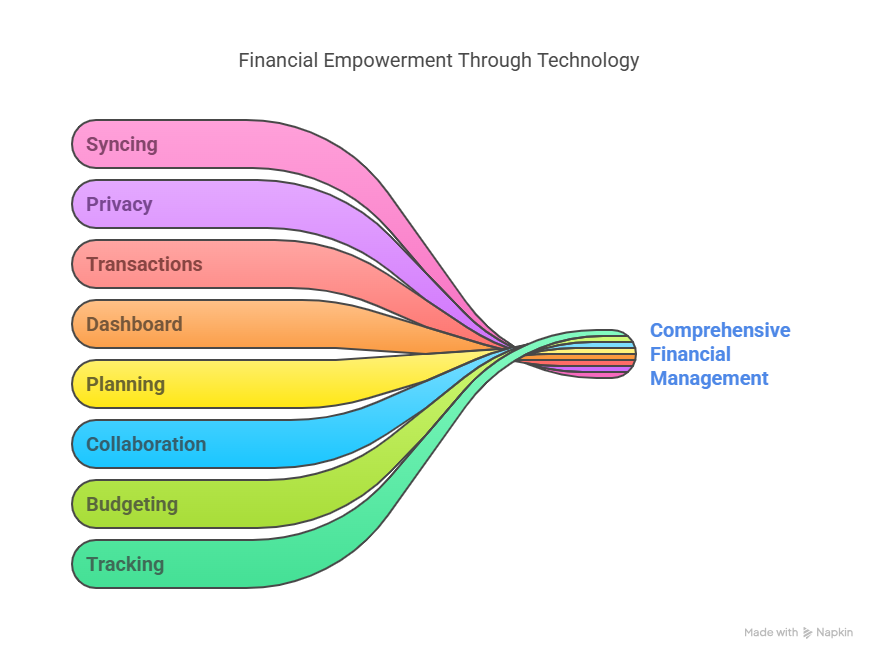

Using Technology For Expense Tracking

Technology can simplify expense tracking. Monarch Money is an excellent example:

| Feature | Description |

|---|---|

| Tracking | Monitor your net worth, spending, and cash flow. |

| Budgeting | Create flexible budgets that adapt to your lifestyle. |

| Collaboration | Share financial information with partners at no extra cost. |

| Planning | Set and track goals for various financial objectives. |

| Dashboard | Customize your dashboard with essential insights. |

| Transactions | Review and manage transactions with customizable preferences. |

| Privacy | Ad-free experience with a commitment to not selling your data. |

| Syncing | Connect with 13,000+ financial institutions for real-time updates. |

Monarch Money provides a comprehensive view of all financial accounts in one place. It enables precise tracking and budgeting tailored to individual needs. The platform helps users set and achieve financial goals efficiently. Reliable syncing with numerous financial institutions ensures accurate data.

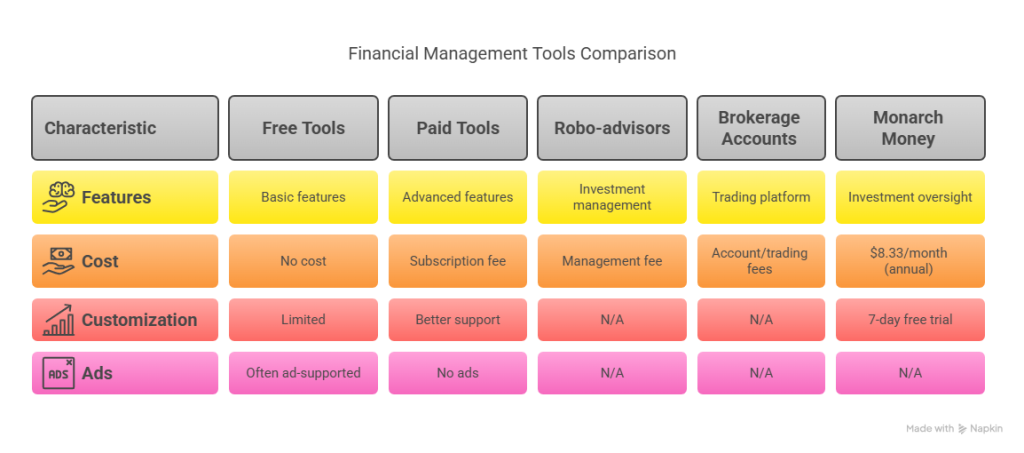

Pricing And Affordability Of Financial Management Tools

Personal finance management tools are essential for overseeing budgets, tracking expenses, and planning for the future. These tools come with varying price tags and features, making it crucial to find one that fits both your needs and budget.

Free Vs Paid Financial Tools

There are both free and paid financial management tools available. Free tools often provide basic features like expense tracking and simple budgeting. They are suitable for individuals who need a straightforward way to manage their finances without spending money.

- Free Tools: Basic features, limited customization, often ad-supported.

- Paid Tools: Advanced features, better support, no ads.

Monarch Money offers a 7-day free trial to help you evaluate its features before committing to a plan.

Cost-effective Solutions For Budgeting And Saving

Finding a cost-effective solution for budgeting and saving can make a significant difference in financial health. Many platforms offer affordable plans that provide extensive features.

Add more rows as needed

| Platform | Monthly Cost | Annual Cost |

|---|---|---|

| Monarch Money | Not specified | $8.33 per month (billed annually at $99.99 plus taxes) |

Monarch Money’s annual plan is priced at $8.33 per month, making it an affordable option for comprehensive financial management.

Investing Platforms And Their Costs

Investing platforms vary in cost depending on the services offered. Some platforms charge a monthly or annual fee, while others may take a percentage of your investments.

- Robo-advisors: Often charge a small management fee, usually around 0.25% to 0.50% of your assets.

- Brokerage Accounts: May have account maintenance fees or trading fees.

- Monarch Money: Includes investment oversight features within its subscription plan.

Using Monarch Money, you can track your investments without incurring additional fees beyond the subscription cost.

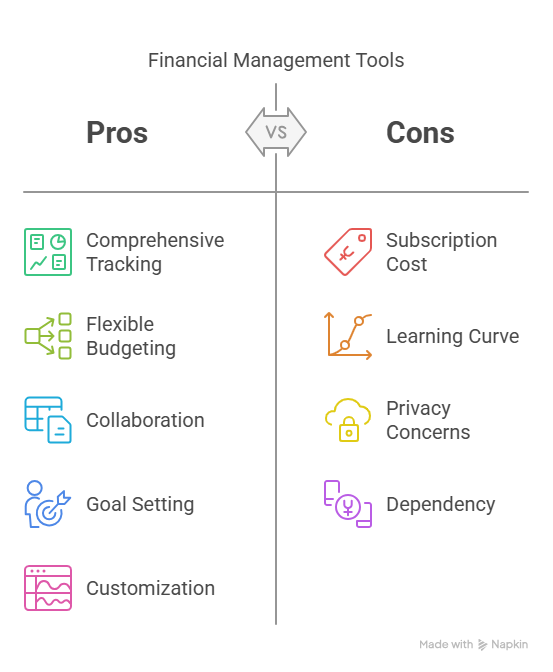

Pros And Cons Of Personal Finance Management Tools

Personal finance management tools have become essential for those who wish to take control of their financial lives. These tools, like Monarch Money, offer a range of features to help you track expenses, budget, and plan for future goals. However, every tool has its advantages and potential drawbacks. Let’s delve deeper into the pros and cons.

Advantages Of Using Financial Management Tools

Financial management tools simplify the complex task of managing money. Here are some key benefits:

- Comprehensive Tracking: Tools like Monarch Money allow you to monitor net worth, spending, and cash flow all in one place.

- Budgeting: Create flexible budgets that adapt to your lifestyle, helping you stay on top of your spending.

- Collaboration: Share financial information with your partner or financial professional at no extra cost, ensuring everyone is on the same page.

- Goal Setting: Set and track goals for significant purchases or events, such as vacations or home remodels.

- Customization: Customize your dashboard with widgets for essential insights, making it easier to focus on what matters most to you.

- Ad-Free Experience: Enjoy a private and ad-free user experience, ensuring your data remains secure.

- Real-Time Updates: Connect with over 13,000 financial institutions for accurate, real-time data.

Potential Drawbacks And Challenges

Despite their many benefits, financial management tools may present some challenges:

- Cost: Some tools, like Monarch Money, offer a free trial but may require a subscription fee for continued use.

- Learning Curve: There can be a learning curve for new users unfamiliar with digital finance management.

- Privacy Concerns: Although tools like Monarch Money commit to not selling your data, some users may still have concerns about privacy and data security.

- Dependency: Relying heavily on automated tools may reduce the user’s engagement and understanding of their finances.

Balancing Manual And Automated Management

Finding the right balance between manual and automated financial management is crucial:

- Manual Monitoring: Regularly review your financial summaries and reports to stay engaged and informed about your finances.

- Automated Rules: Use AI-based rules to automate and organize transactions, which can save time and reduce errors.

- Custom Preferences: Set customizable preferences to ensure that the automated system aligns with your specific financial goals and habits.

By balancing manual oversight with the convenience of automation, you can ensure a more comprehensive and effective approach to personal finance management. Tools like Monarch Money provide the flexibility and customization needed to tailor your financial management process to your unique needs.

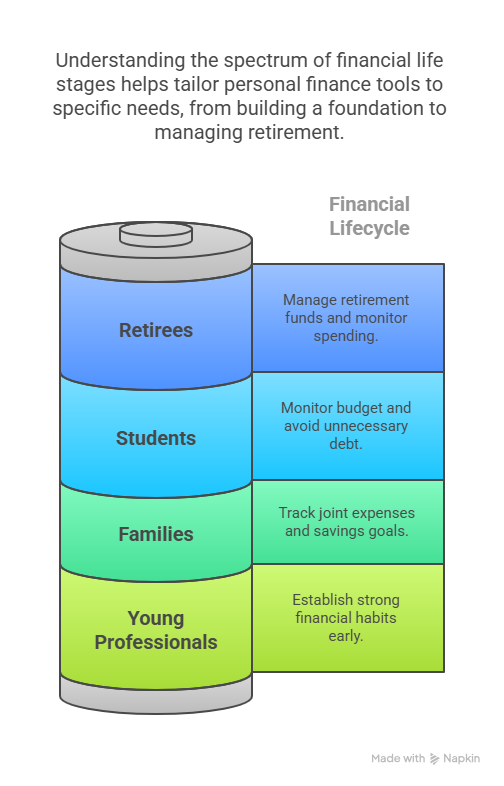

Recommendations For Ideal Users Or Scenarios

Personal finance management tools like Monarch Money offer valuable support for managing finances. They provide a clear view of your financial health. The following recommendations help identify who benefits most from these tools and the scenarios where they are essential.

Who Can Benefit Most From Personal Finance Management

Several groups of people can greatly benefit from using personal finance management tools:

- Young Professionals: Those starting their career can manage their income and expenses efficiently.

- Families: Families can track joint expenses and savings goals.

- Students: Students can keep an eye on their budget and avoid unnecessary debt.

- Retirees: Retirees can manage their retirement funds and monitor their spending.

Scenarios Where Personal Finance Tools Are Essential

There are specific scenarios where personal finance tools become essential:

- Debt Management: Tools like Monarch Money help track and manage debts efficiently.

- Budgeting: Creating and sticking to a budget is easier with real-time updates.

- Investment Oversight: Monitor investments and track their performance over time.

- Goal Setting: Set financial goals like vacations or home remodels and track progress.

- Financial Collaboration: Share financial information with a partner or financial professional.

Tailoring Financial Management Strategies To Individual Needs

Personal finance management strategies must be tailored to individual needs. Monarch Money offers customization options:

- Customizable Dashboard: Users can prioritize insights with widgets.

- Flexible Budgets: Budgets can adapt to different lifestyles and needs.

- Transaction Management: Review and manage transactions with customizable preferences.

- Automated Rules: Use AI to automate and organize transactions for efficiency.

These features ensure that users can effectively manage their finances in a way that suits their unique situations. Monarch Money provides a comprehensive and secure platform for all your financial management needs.

Frequently Asked Questions

What Is The Meaning Of Personal Finance Management?

Personal finance management means organizing and controlling your income, expenses, savings, and investments to achieve financial stability and goals.

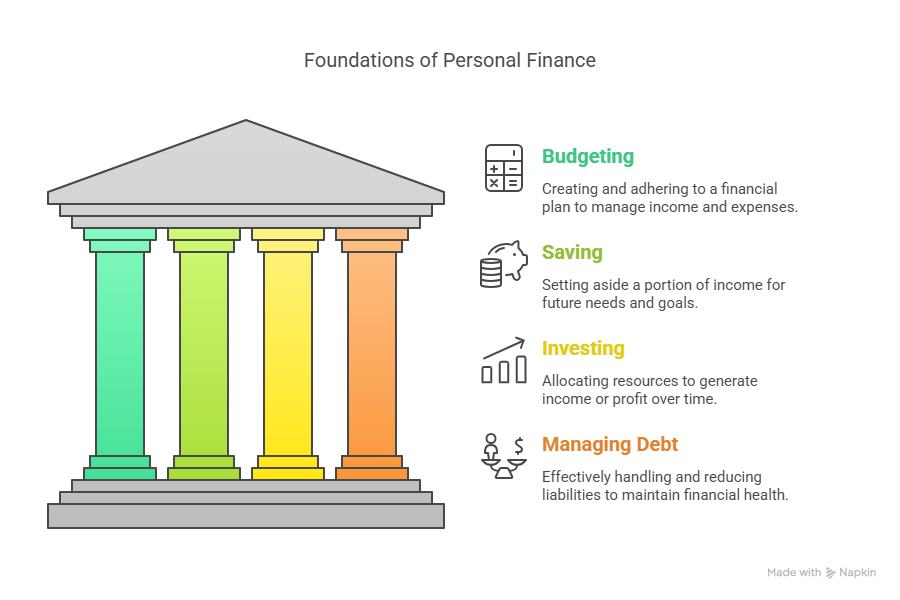

What Are The 5 Basics Of Personal Finance?

The 5 basics of personal finance are budgeting, saving, investing, managing debt, and planning for retirement.

What Are The 5 Main Components Of Personal Finance?

The 5 main components of personal finance are budgeting, saving, investing, managing debt, and planning for retirement.

What Is Personnel Financial Management?

Personnel financial management involves budgeting, saving, investing, and planning for expenses to achieve financial stability and goals.

Conclusion

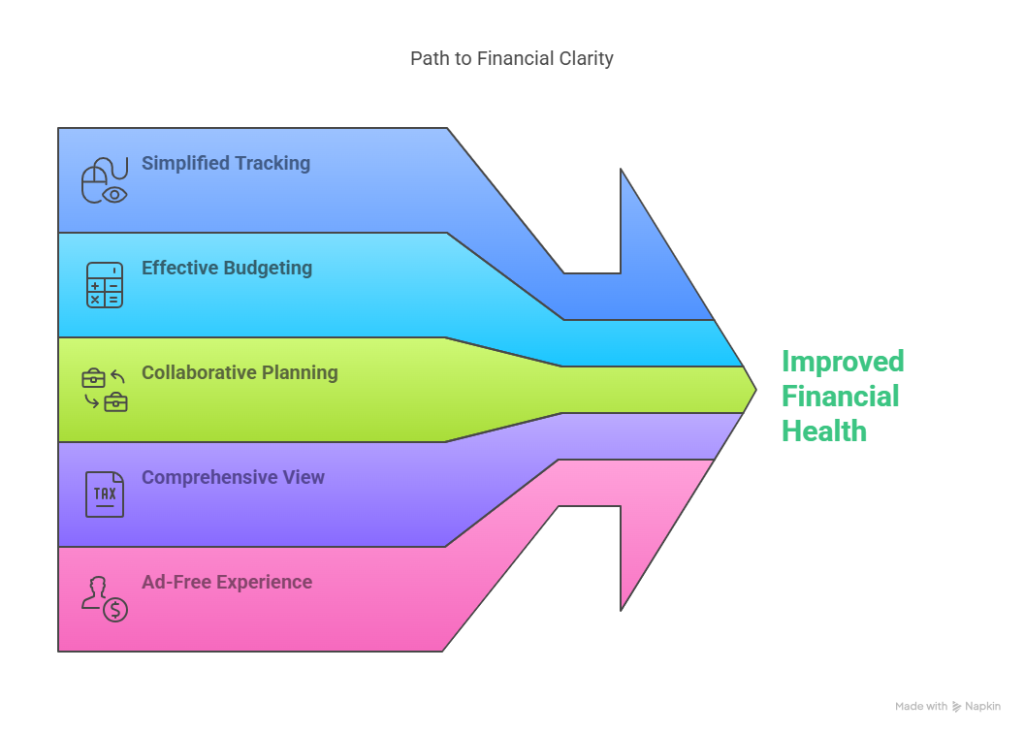

Effective personal finance management can greatly improve your financial health. Using Monarch Money simplifies tracking, budgeting, and planning. Stay organized and collaborate easily with your partner. Set and achieve financial goals with confidence. Monarch Money provides a clear, comprehensive view of your finances.

Enjoy a private, ad-free experience while managing your money. Start your journey towards financial clarity today with Monarch Money.

Thank you for taking the time to read my article “Mastering Money: Best Personal Finance Management Tips for 2025.”